south dakota vehicle sales tax exemption

The purchaser is a tax exempt entity. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36.

Cars Trucks Vans South Dakota Department Of Revenue

SDL 32-5-2 are also exempt from sales tax.

. South Dakota SSUTA SD. A title transfer fee of 1000 will apply. Exempt Entity Fees Renewal Fees No motor vehicle excise tax is due on vehicles owned by the above indicated entities.

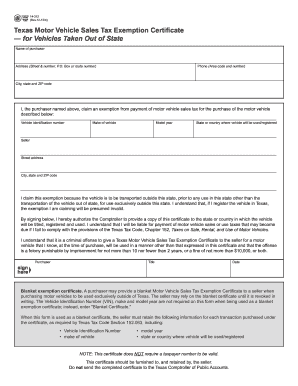

The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. Sales Tax Guide Below are the 4 reasons a transaction may be exempt from paying South Dakota Sales Tax. If the entity purchasing the product or service is listed below please have them complete an Exemption Certificate.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. Dealers are required to collect the state sales tax and any. SDCL 10-45 A use tax of the same rate as the sales tax applies to all goods products and services that are used stored or consumed in South Dakota on which South Dakota sales tax was not paid.

Otherwise purchaser must comply with either rule 570310 or 570325 of the Admin. The purchaser or consumer of the goods or services is respon-. There are four reasons that products and services would be exempt from South Dakota sales tax.

South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. AND 2reside on Indian country as defined by 18 USC. The purchaser submits a claim for exemption.

A vehicle is exempt from tax when it is transferred without consideration no money is exchanged between spouses between a parent and child and between siblings. Codified Laws 10-45-9. Purchases of motor vehicles or other tangible personal property required to be licensed or titled with a taxing authority taxed under Title 32.

Vendors of motor vehicles titled watercraft and titled outboard motors may use this certificate to purchase these items under the resale exception. Use tax is also collected on the consumption use or storage of goods. Governmental or sales tax exempt agency.

Laws 44-18-30 Gross Receipts Exempt from Sales and Use Taxes South Carolina SC. There is a 620 plate fee plus a 500 mailing fee. South Dakota Sales Tax.

Search for a job. First retail sale of vehicle is taxable. Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and.

1151 in South Dakota that is governed by the tribe in which you are a. One exception is that the sale or purchase of a motor vehicle subject to the motor vehicle excise tax is not subject to sales or use tax. The product is delivered to a point outside of the State of South Dakota.

The state of South Dakota provides only one form to be used when you wish to purchase tax-exempt items such as prescription medicines. South Dakota is subject to sales or use tax. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must.

South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. If the plates are transferred from one vehicle to another a 5 reassignment fee is due. The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2.

South Dakota Department of Revenue. 12-36-2120 Exemptions from sales tax South Carolina Revenue Ruling 13-2. Motor vehicles exempt from the motor vehicle excise tax under.

There are hereby specifically exempted from the provisions of this chapter and from the computation of the amount of tax imposed by it the gross receipts from sales of tangible personal property and the sale furnishing or service of electrical energy natural and artificial gas and communication service to the United States to the State of South Dakota or to any other. This includes the following see. Motor Vehicle Exemptions 14-Any motor vehicle sold or transferred which is eleven or more model years old and which is sold or transferred for 2500 or less and any boat which is eleven or more model years old and which is sold or transferred.

- All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. The purchaser is a tax exempt entity.

Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27. United States government agencies State of South Dakota Indian tribes. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just. These states are Alaska Delaware Montana New Hampshire and Oregon. 1be an enrolled member of a federally recognized Indian tribe.

Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. Local jurisdictions impose additional sales taxes up to 2. Exemptions from Sales Tax.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. The product or service is specifically exempt from sales tax. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission.

Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27. First retail sale of vehicle is taxable. E Capitol Ave Pierre.

This means that you save the sales taxes you would otherwise have paid on the 5000 value of your trade-in. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The governments from states without a sales tax are exempt from South Dakota sales tax.

The range of total sales tax rates within the state of South Dakota is between 4 and 65. In South Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. The state of South Dakota levies a 4 state sales tax on the retail sale lease or rental of most goods and some services.

Vehicle Removals For Individuals And Businesses South Dakota Department Of Revenue

Tx Form Sales Tax Exemption Fill Out And Sign Printable Pdf Template Signnow

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

My Vehicle Title What Does A Car Title Look Like Car Title Title Nevada

Trucking South Dakota Department Of Revenue

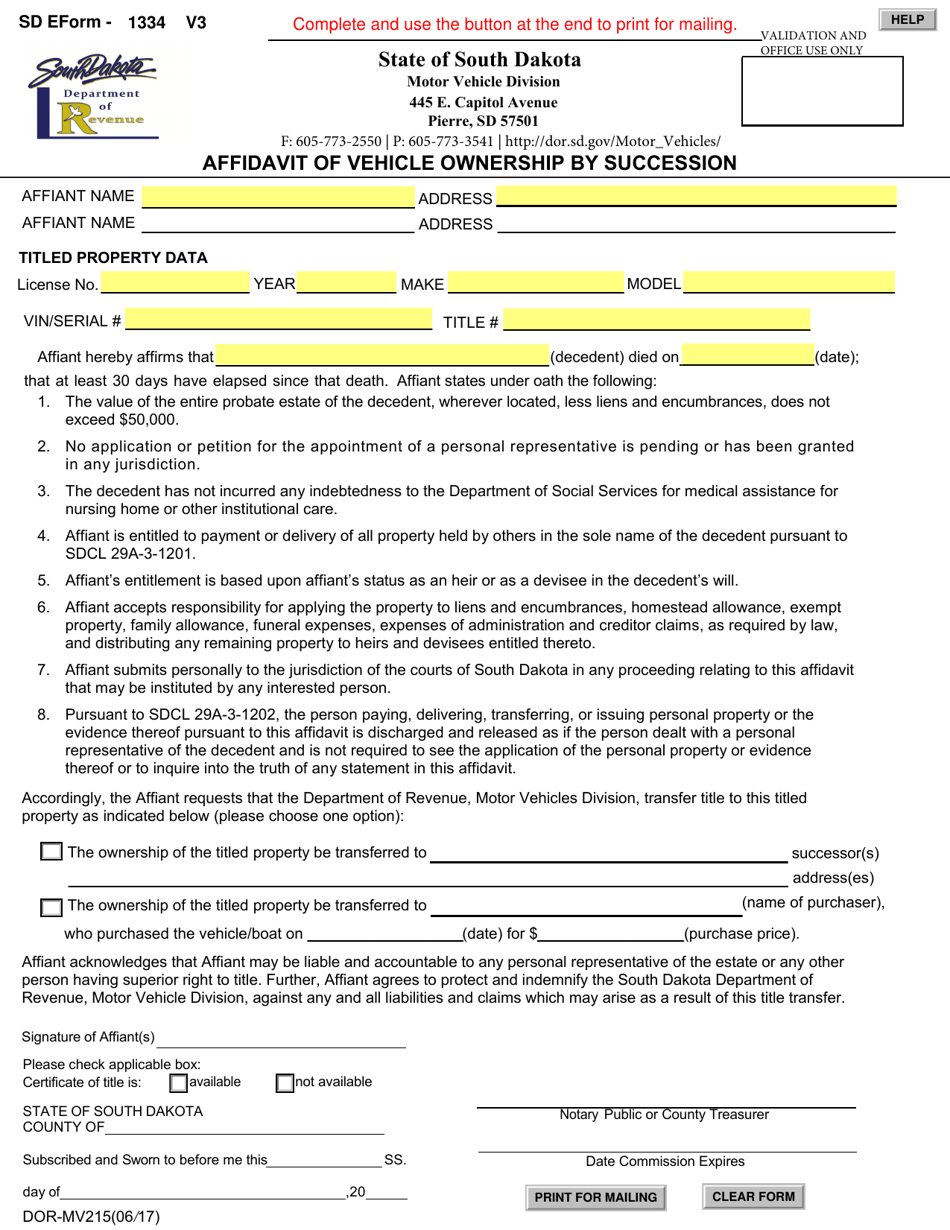

Sd Form 1334 Dor Mv215 Download Fillable Pdf Or Fill Online Affidavit Of Vehicle Ownership By Succession South Dakota Templateroller